16 Jul Oregon Cannabis Litigation: Business Between Friends Leads to $4.2 Million Lawsuit

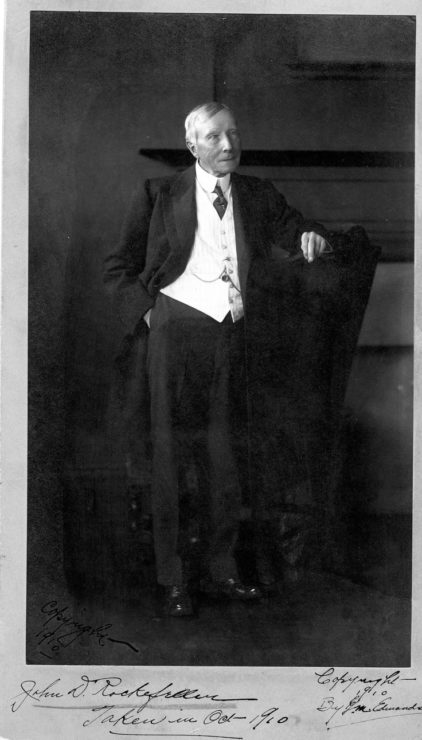

“A friendship founded on business is a good deal better than a business founded on friendship,” said John D. Rockefeller. In our experience, this adage applies with force in the cannabis industry where –because of its black-market origins – people became accustomed to business arrangements founded on a handshake when recourse from the legal system was not an option. Times have changed and so should the practice of cannabis businesses as demonstrated by a $4.2 million lawsuit recently filed in Oregon state court.

The principals of Mason Family Farms (“Mason”) were close friends with Edward Passadore. In 2015, Mason sought to enter Oregon’s recreational marijuana market by establishing a 15,000 square foot indoor cultivation facility in Lowell, Oregon. Passadore, who owned a property management company and founded several other companies (together referred to here as “Passadore”), convinced Mason that he and his associates had the expertise and experience to construct and deliver a licensed “turnkey” grow operation.

The year 2015 was a heady time for Oregon’s newly legalized recreational marijuana industry. Mason anticipated that its cultivation operation would produce approximately 5 ½ harvests per year of 463 pounds of marijuana per harvest. At a wholesale price of $2,000 / lb, Mason expected to net approximately $711,000 in profit per harvest. (Regular readers know that by early 2019, Oregon’s supply had vastly exceeded demand, causing prices to crater and that Oregon recently adopted various measures intended to curb supply).

Sometime in early 2016, Mason and Passadore reached an agreement by which Passadore would construct the grow operation for $1,000,000. According to the complaint, Passadore agreed to secure all necessary permits and licenses, construct the project, secure water rights, set up security, and take all other necessary actions. The parties anticipated the project would cost $1,000,000 of which 17.5% total project cost would be paid to Passadore, for a total anticipated cost of $1,175,000. Passadore allegedly orally promised the project would be completed by December 2016.

Remarkably for a $1 million deal, the contract was a apparently a combination of oral and written promises and Passadore retained the only signed copy of the contract. The unsigned version of the contract attached to the complaint does not include an integration clause, which typically exclude from the contract terms all prior oral or written agreements. (This is Contract Law 101.) The writing does not contain a deadline for completing the project and is missing numerous other terms you’d normally see in a build-out arrangement, e.g.: change orders, permit requirements, indemnity, insurance, third-party liability, contractor-subcontractor, found in basic construction contracts. (Check out the AIA Contract Documents, https://www.aiacontracts.org/.)

The written contract called for an initial deposit of $500,000 – which Mason provided to Passadore by the end of March 2016. In May 2016, Passadore ordered two large greenhouse kits for delivery. In July 2016, Mason provided Passadore the remaining $500,000. The time for completion came and went and in January and May 2017, Mason provided Passadore with additional money bringing the total money deposited to $1.6 million.

Construction on the project dragged on into the summer of 2017 and then ground to a halt when the electrical subcontractors stopped work after learning that Passadore had not obtained the required permits. Construction recommenced in the fall of 2017, but by early 2018 Mason had taken over and terminated its relationship with Passadore. Mason then spent another $672,000 to get the operation up and running by April 2018. By then, the wholesale price of marijuana had dropped to $800 / lb.

(Note: Mason earned a 1st Place – Greenhouse award at the 2018 Oregon Growers Cup for its White Tahoe Cookies #1 strain).

Meanwhile, Mason had become suspicious of the documentation Passadore had provided concerning the costs of the project. Mason repeatedly demanded supporting documentation, which it never received and came to believe that Passadore had falsified or misreported numerous charges. Passadore also allegedly commingled funds between companies and changed the names of various companies to confuse Mason and attempt shield assets.

This brings us to complaint. Mason alleges causes of action for declaratory judgment, equitable accounting, breach of contract, and seeks to pierce the corporate veil of Passadore’s various entities. (For the unfamiliar, veil piercing is briefly discussed here). The complaint seeks $897,000 in contract damages as the difference between the contract price and the amount Mason expended to complete the project and $3,357,000 in lost profits based on the theory that Passadore caused Mason to lose out on seven harvests. (Feel free to email me if you’d like a copy of the complaint).

The lessons here are obvious, but we keep seeing marijuana and hemp businesses make the same avoidable mistakes. For some primers on entering into and succeeding in the cannabis industry, take a look at:

Sorry, the comment form is closed at this time.